Part of our Banking, Financial Services & Insurance thought leadership series

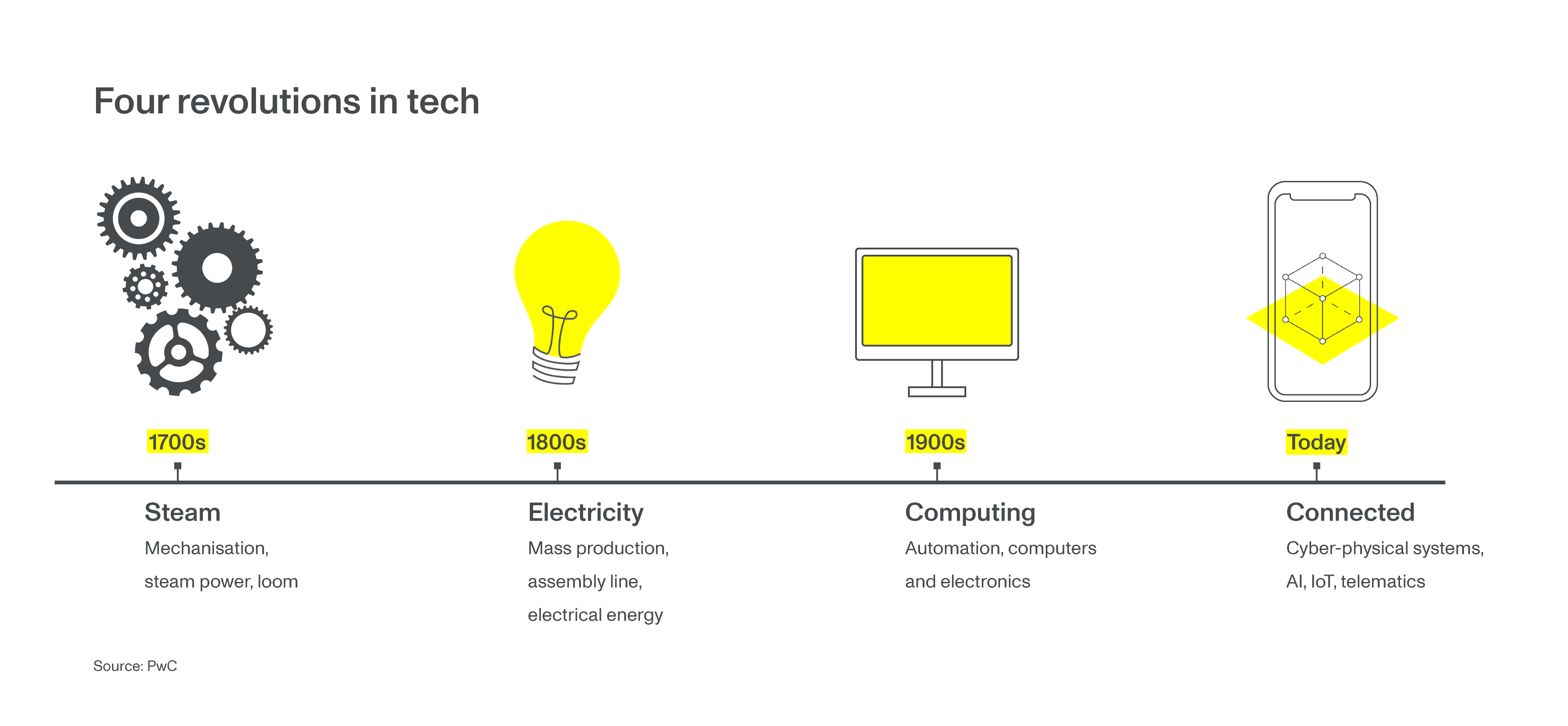

This year, we’re seeing insurance businesses take more leaps towards innovation and make clear efforts to catch up after lagging behind banks and other industries in tech innovation in the last decade [1]. With InsurTechs at the forefront of driving digitisation in the market at the height of what is thought to be the fourth industrial revolution [2], investment toward digital across the globe has grown from 7 billion USD in 2019 to over 14.6 billion in 2021 [3].

Source: [2]

This positive digital disruption presents the industry with the perfect moment and a unique opportunity to push past its ‘traditional’ boundaries in step and connection with the rest of the world and to unlock more value for stakeholders through technology. Key players who have recognised this are on a quest to recast insurance into a better-adapted and future-proof role in society through the following trends.

Product Innovation Powered by Data Analytics and Machine Learning

The insurance industry has been in operation for a very long time. The earliest record of an insurance policy has been traced to a Babylonian law code from around 1750 BC [4]. And the essential structure of the business as we know it today has been deployed in the US since the 18th century [1]. Those who have endured the long history of the business considered their continued success a result of consistent and reliable performance. And they were further convinced by the descent of companies with irregular structures and incompetent distribution systems.

Because of this, the industry has matured to equate effectiveness with consistency and operational stability. And though reliability and standard procedures are commonly favourable for business, the clientele’s changing tastes and needs are upending what determines success in the market. What has worked for these companies then may not necessarily translate into equally good standing now.

Today, industry players are learning the importance of being more dynamic and well-adjusted. Ergo, a widespread shift in priority towards product innovation enabled by digital solutions has transpired. By maximising the combined powers of data analytics and machine learning to better and faster calculate risks, align pricing, and estimate Customer Lifetime Value (CLV), insurance companies are now able and active in innovating their products based on more contemporary lifestyles, data, and customer profiles. And the market response to pioneers employing this strategy and embracing the possibilities tied along with it demonstrates significant opportunities for companies willing and committed to innovate.

Improved Customer Experience through Integrated Connectivity

Tethered with the fourth industrial revolution and with greater customer expectations, insurance companies are taking customer-centricity to the next level – connecting their services and being more attentive to various aspects of their clients’ more digital lifestyle and daily engagements.

Health and fitness, for example, have been cumulatively digitised for most of the industry’s target group – millennials. This is evident in how these clients now use online platforms to learn about and track their health, as well as purchase wearables to monitor heart rates, daily activity, and even sleep schedules far more than older generations. This rise of digital in adjacent industries has provided insurance with a wealth of data and a host of opportunities to more easily extend their insight, reach, and influence into customers’ lives and service their customers with a more natural, overall better flow.

In the case of life and health insurance, by extracting health and activity data provided by the modern wellbeing industry and collected through IoT-linked devices and using it to gage health levels, not only do insurers shorten and simplify the KYC process significantly – creating a more convenient and seamless onboarding experience for customers, they can also more accurately perceive risks and adjust policy features accordingly. A perk of utilising real-time data in lieu of user-provided data based on imperfect memory.

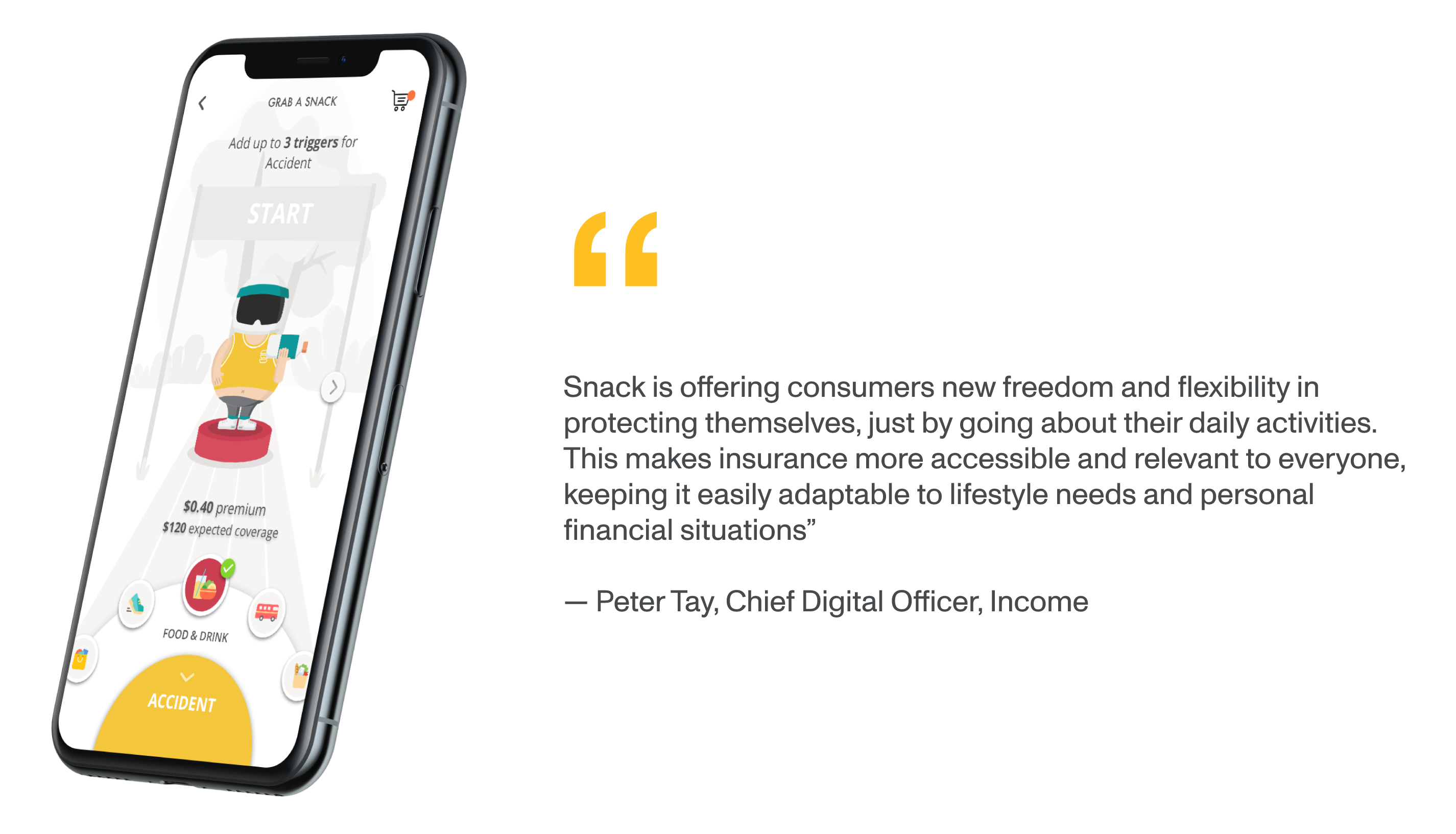

National Trades Union Congress – Income (NTUC-Income), which partnered with Monstarlab for their Snack by Income mobile app, perfectly demonstrates the wonders that connectivity can do for insurance. By creating an app fit for today’s digital lifestyle and developing a user flow that allows micro-investments to automatically align with regular spending habits and including a wide selection of partner merchants and brands integrated into the system, the company and app are able to penetrate the market more easily and connect with clients on a deeper level. And their success became even more evident as they placed 1st runner up in the Singapore Financial Institution Category of the Singapore Fintech Festival in 2021.

You can read more about Snack by Income in this case and about IoT data’s impact on insurance in this article.

These are just some of the many ways that companies in the insurance market are grounding and improving their customer experience with connectivity. P&C and non-life insurances, for example, can also link up with digital automobile maintenance channels, city council and other property evaluation databases, and other digital systems from other industries to the same effect.

As consumers progressively embrace digital channels, with the vast majority accustomed to and anticipating positive experiences, expectations for the same – if not better-quality experiences in insurance likewise propagate. With this, the shared seamless experience has become the gold standard.

Creating Collaborative Insurance Ecosystems

This year, well-established insurers have started collaborating with the market’s newcomers. Inspired by the recent success of budding firms and providers that have built their foundations on technology, and simultaneously challenged by the rapid evolution of the market, legacy companies have started forming partnerships and placing significant investments in more digitised insurance startups and scale-ups [3].

According to research, legacy companies have become some of the largest financiers behind these startups in the belief that collaboration will become the turning point that their business and the industry needs [2].

With these recomposed ecosystems, insurers aim to combine extensive industry experience with fresh and modern solutions and talent to transform the landscape. And a significant portion of the group has expressed growing interest and general intention to influence mobility, healthcare, and smart places [5]. In consideration of the newfound capabilities and prowess of operating in collaboration, the prospect of attractive returns, and the imperative to continuously deliver stakeholder value, more businesses in this arrangement can be expected to emerge and flourish.

Visit our banking, financial services & insurance page to learn more and check out some of our projects around this vertical. More expert pieces on technology reshaping insurance:

How is Blockchain Impacting the Insurance Industry?

Evolve from being Traditional Insurers to InsurTechs with IoT Data

Experts Featured

Saad Kamal

Follow on LinkedIn | saad.kamal@monstar-lab.com

Saad, Managing Director of Monstarlab Singapore, has more than a decade of experience in driving digital transformation for government and large multinational organizations alike. Delivering world-class and award-winning digital solutions for various industries including banking & insurance, transportation, and smart places.

Learn more about Monstarlab Singapore.

Tobias Morville

Follow on LinkedIn | tobias.morville@monstar-lab.com

Tobias is the Head of Machine Learning at Monstarlab. He has a PhD in Computational Neuroscience and has worked with designing, developing and deploying machine learning models in both Danish and international companies for the last four years.

Learn more about Monstarlab Denmark.

Endnotes:

[1] Omega Computer Services, “Why insurance lags behind other industries with the integration of new tech”, 2019

[2] PwC, “How insurers can seize InsurTech opportunities”, 2022

[3] McKinsey & Company, “Creating value, finding focus: Global Insurance Report 2022”

[4] Risk Engineering. “Insurance and Risk: Some History”, 2020.

[5] OECD, “Technology and innovation in the insurance sector”, 2017

![Industry leaders are maximising analytics and machine learning technologies’ capabilities across the value chain as well. For instance, some of the leading P&C insurers have observed three- to five-point improvements in their loss ratio with these integrations. Lucrative segment retention has also doubled from 5 to 10%. Best of all, novel business premiums have effectively increased by as much as 15% for companies including those at the top of the chain [3].](https://dev-test.monstar-lab.com/global/assets/uploads/2022/04/Graphs-redesign-Recovered_Artboard.png.webp)

![Data suggests that insurance ecosystems can surpass 60 trillion USD in revenue by 2030 [3].](https://dev-test.monstar-lab.com/global/assets/uploads/2022/04/Graphs-redesign-Recovered_Artboard-copy-5.png.webp)